[ad_1]

Receive free global updates

We will send you a MyFT Daily Summary email gathering the latest news from the world every morning.

Hello. This article is an on-site version of our FirstFT newsletter. Subscribe to our Asia, Europe / Africa Where Americas edit to send it straight to your inbox every weekday morning

Did you follow the news well this week? Take our quiz.

Investment banks reap save sums, with fees exceeding $ 100 billion in the first nine months of the year thanks to a rush in transactions.

Major Wall Street banks and major specialist advisers have benefited from the boom in mergers and acquisitions as well as the boiling capital markets. Fees for both are at the highest level since the record began two decades ago and have reached $ 60.6 billion since the start of the year, according to Refinitiv.

Lenders also earned $ 52 billion in underwriting loan and debt offers in the first nine months of the year, as companies rushed to lock in low rates.

Five U.S. banks, led by JPMorgan Chase and Goldman Sachs, took the largest share of the $ 112.6 billion in fees earned this year. The two Wall Street lenders are estimated to have collected a combined fee of $ 18 billion.

Thanks for reading FirstFT Europe / Africa and have a good weekend. See you Monday – Jennifer

Five other articles in the news

1. Britain’s ‘Autumn Storm’ of Shortages, Costs and Taxes Business leaders have warned ministers of tax hikes, escalating costs, labor shortages and supply disruptions in the fall as government support programs Covid-19 end.

2. Nancy Pelosi moves forward with infrastructure vote The president appeared determined to move forward with a decisive vote on President Joe Biden’s bipartisan $ 1.2 billion infrastructure bill in the United States House of Representatives yesterday, even as the Progressive lawmakers threatened to defeat the legislation. Lawmakers yesterday too avoided a government shutdown with a short term finance bill. (FT, Politics)

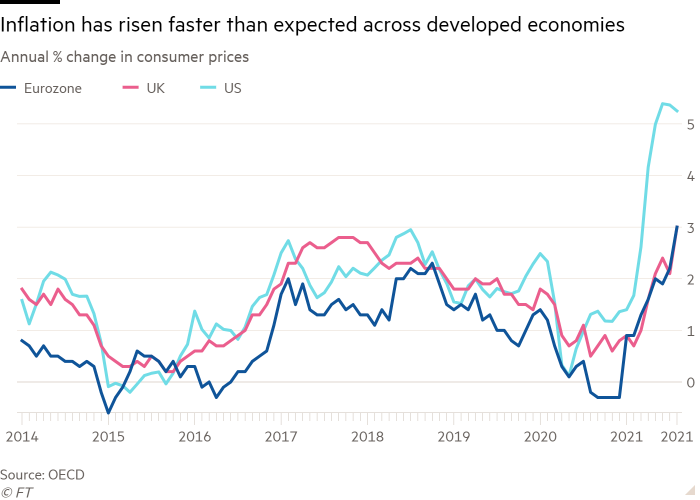

3. Fears of stagflation intensify With oil exceeding $ 80 a barrel, global food prices a third more expensive than a year ago, and other commodities at decade-highs, investors say an inflationary surge longer than forecast coincides with a slowdown in growth – and worsens it.

4. Zoom and Five9 drop $ 14.7 billion deal Zoom Video Communications’ offer to buy the cloud-based software provider collapsed just weeks after the US Department of Justice raised national security concerns over the deal and shareholders were invited to vote against the takeover by a powerful proxy group.

5. Cambridge Guidelines for Reducing the Risks of Engaging Abroad Vice Chancellor Stephen Toope will announce today guidelines for students and academics on project navigation when working with countries that “do not share the UK’s commitment to democracy and the rule of law” amid “growing political tensions “, after the university was criticized for its ties to China.

Coronavirus digest

-

Only a third of African countries have fully immunized 10% of their population by the end of September, the World Health Organization said.

-

Actions in Oxford Nanopore, which makes devices to analyze Covid-19 variants, has jumped more than 40% after its London IPO.

-

Manufacturing activity in China suffered its first official contraction since the start of the pandemic amid widespread power shortages.

-

The students oppose Learning “YouTube” as campuses reopen.

The day to come

Eurozone inflation figures Eurozone inflation is expected to hit a 13-year high in September, boosted by soaring energy costs and strong demand as economies reopen. Economists too forecast further increase in consumer prices for the same month. (FT, WSJ)

Dubai World Expo After a year of delay, Dubai Expo 2020 will start today. Participants will be required to present proof of vaccination or a negative Covid-19 test. The event is expected to be one of the biggest face-to-face events since the start of the pandemic. (Bloomberg)

Hollywood strike vote Members of the International Alliance of Theater Workers plan to vote on whether 60,000 behind-the-scenes workers should step down after claiming they can no longer earn a living wage.

Join us October 7 and 8 for the Moral Money Summit Americas, debate money, regulation and how businesses can act more responsibly. Register now here to receive the Moral Money newsletter to your inbox.

What else do we read

Taliban face reality Providing the administrative services Afghans are accustomed to is a daunting task in an era of economic collapse, withdrawal of Western financial support and an exodus of expert administrators since the Taliban takeover. But there is one service that is both available and popular under Islamists: swift justice.

-

Imran Khan’s bet: Pakistan seeks to re-establish itself as a strategic bridge to Afghanistan for the great world powers. The question is whether his support for the Taliban will pay off or trigger a new wave of Islamist extremism.

Gordon Brown: the reduction in universal credit widens the gap in the UK As Boris Johnson prepares to cut universal credit to £ 98 per week, he and his cabinet should reflect on what that means for the food on the table and the heating of the family home. Twenty pounds may not seem like much to many, but for families on the brink, it’s a lifeline, writes the former prime minister.

Europe must not become a military power A stronger army would do the continent more harm than good. Instead, he should play on his strengths, from sanctions and diplomacy to soft power, writes Simon Kuper. Moreover, if the goal is to save lives, Covid-19 reminds us that it is better to expand our precious welfare state.

Algorithms could guide decisions – if they work Life is full of tough decisions. Who should be hired or fired? What marks should students receive on their exams? An increasingly popular solution is to delegate these decisions to a data-driven algorithm. But many of them have been trained on racist and sexist information, and it shows, writes Tim Harford.

The “psychological wealth” return to power Next week, Jemima Kelly will slowly begin The Great Return to the office. She’s a little nervous – trying to concentrate in a busy newsroom, having to look tidy, the messy business of dealing with other human beings. But what she fears the most is “losing the sense of well-being” she has felt in recent months.

Reader’s response

Thanks to the readers who wrote their thoughts on UK plans to shift green surcharges from household electricity bills to gas bills.

“It makes perfect sense – there is no incentive to use electricity as the primary source of heat – it is much more expensive than gas even after taking into account the higher upfront costs of a gas boiler. . ” – Laurence Julius

Remember that you can add FirstFT to myFT. You can also choose to receive a FirstFT push notification every morning on the app. Send your recommendations and comments to [email protected]

[ad_2]